Landlords often focus so much on the monthly rent amount that they lose sight of total annual revenue. They make the mistake of starting with their mortgage amount and set the rent amount based on their mortgage plus property management and whatever other expenses they have such as insurance. I hate to break the news, but no potential tenant cares one bit how much the property owner’s mortgage amount is. Renters only care about what value they will be receiving for their rent payment. I can certainly empathize with a homeowner who will be renting in a negative cash flow situation. Most of the time, the homeowner in this situation has made the decision to rent in order to avoid having to take a huge loss if they were to sell a home. They turn to the option of renting, which is a great short-term solution, and cross their fingers and hold their breath, hoping that renting will mean they can avoid a loss by pushing the sale into the future. They lose focus of the fact that even if the rent doesn’t quite cover their mortgage each month, it covers most of it, and every mortgage payment pays down their principal, buying them more equity in their property each month.

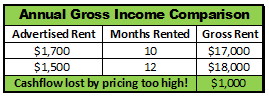

If you set your rent amount so high that everyone looking for a rental in your area skips right over yours because comparable properties are available for less money, your property may sit vacant for months. Having a property sit vacant for 60 days longer than necessary will, in almost every scenario, cost more than just lowing the rent by a couple hundred dollars. For example, if you set the rent at $1700 when all the other units like yours are being advertised for $1500, possibly you will eventually find just the right prospect willing to pay your rent, but it will take much longer. Let’s look at a landlord’s gross rents received in the example below that assumes it takes 60 days longer to find a person willing to pay a premium price. (NOTE – It may take longer than 60 days.)

When you are selling or buying a house, square footage is the most significant factor in determining value. With a rental though, the number of bedrooms and bathrooms are the most critical factors that determine what a renter will pay, more so than the square footage of the home. People are not going to pay more in rent because a house has a couple hundred extra square feet. They will pay more if it’s more updated than the others or if it has a garage, but not as significantly as one would think.

It is critical to evaluate what competition you have on the day you go to market. Don’t just look at your neighborhood. Expand your area of the city to include at least the entire high school district. If you are in a small town, look at the entire town. Make sure you are comparing properties like yours – single family home vs. townhome vs apartment, etc. You want to see what all the potential renters will be seeing when they open their favorite rental app to decide what properties they are going to schedule appointments to see next weekend. Set your rent amount at a level that will ensure your property will make their list!

Let’s look at an example of something outside of the housing industry that everyone should be able to relate to. Let’s say your favorite pizza shop got an opportunity to upgrade their space to a newer center, and in the process they are going to have a six month overlap until their original lease ends. For this six months they are going to be offering identical menus, the only difference being one shop is a lot prettier because it is brand new in the new shopping center. One Friday evening you decide to go to order pizza and open the shop’s app on your phone to place an order for pick up. You see there are now two locations with the same menu, but different prices. You know the product; it’s your favorite pizza. It’s the same pizza regardless of what location you go to, but if you order at the old location it’s $10 for the pizza, and if you order from the new location it’s $15 for the same pie. Confused, you abandon the app and call the shop. You open with, “I don’t get it. This is the same pizza. Why are you charging a different price?” The employee then explains that “well, you know, the rent’s a lot more at this location so the owner said we have to charge more because we have to be able to cover the rent. If you call the old store you can still get the same pizza at the old price.” Hum… from a consumer standpoint, the only difference is when you go in to pick up the pizza, the new shop looks a little prettier. Knowing what you know about the pizza, as a consumer, will you order the $10 pizza or the $15 pizza?

In the rental market, consumer thinking is no different. If a family is looking for a three-bedroom, two bath house in ABC school district, they look and see what properties are advertised in their price range. If all the houses are in the $1400-1500 range and your house is priced at $1750, your property won’t even be considered. You probably won’t even pop up as an option, because most people filter by price. Even if your property does show in their search, potential renters aren’t even going to open the ad to look at your pictures to see how pretty your house is. Your property will not be relevant, because why would a potential tenant consider paying $1750, when they can get all the features, they want for much less?

I hope this information is convincing enough to encourage you to be realistic about your rent amounts. Take your expenses out of the decision equation. Instead, look at the market data to make the best determination of where you should set the rent to maximize your ANNUAL revenue. Set your rent at the highest price that will encourage qualified tenants to schedule a showing. You need to get them in the door if you want any chance at getting an application and ultimately signing a lease. Make your goal to maximize your annual revenue instead of monthly, which is most easily influenced by minimizing your vacancy time.

If you need help making these tough decisions, Property Management Inc is here to help! If our rental property is in Hampton Roads, VA, PMI Virginia is ready to assist! Click this link to get in touch with us! https://www.virginiabeachpropertymanagementinc.net/virginia-beach-property-management

If your rental is in a different part of the country, visit this link to find the PMI franchisee closest to your investment property. https://www.propertymanagementinc.com/locations